In today’s economic climate, personal loans have become a lifeline for many Americans. But what happens when that lifeline starts to strangle you? The consequences of failing to pay your personal loans are far more severe than you might imagine and they can impact your life in a serious way.

Let’s delve into the dark world of loan default and uncover the terrifying realities that await those who fall behind.

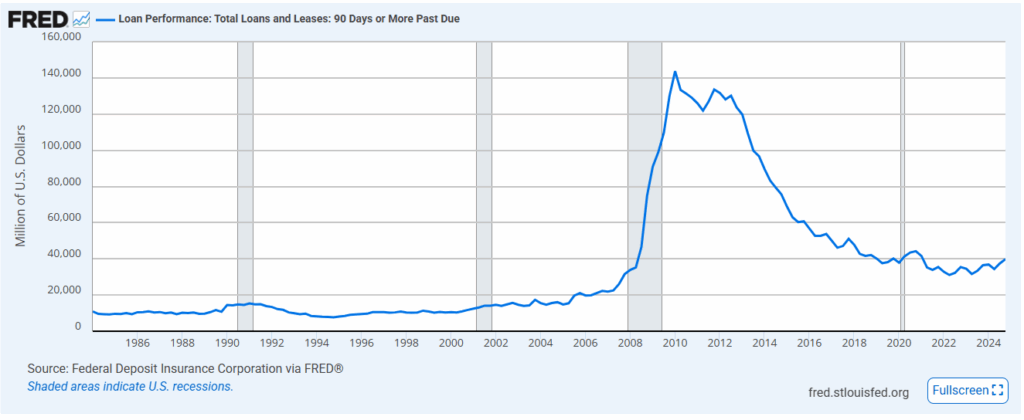

A simple look at the data published by Federal Reserve shows that Americans are missing their loan payments more and more every day. Here’s a simplified version of the FED chart:

More and more people are missing their loan payments but only a few people know that there’s a way out, without having to file for bankruptcy.

In this article, we’ll review some of the most common consequences of a personal loan default and how to deal with them.

The Downward Spiral Begins

Missing a single payment might seem insignificant, but it’s the first step on a treacherous path. Late fees start to accumulate, and your interest rates may skyrocket. Suddenly, that manageable monthly payment becomes a monstrous financial burden.

Your Credit Score: The First Casualty of a Loan Default

Your credit score is the lifeblood of your financial future in this country. When you default on a personal loan, it’s like driving a stake through its heart.

A plummeting credit score, and a negative mark can haunt you for years, specially when it’s a negative mark for a loan payment. It’s going to make it nearly impossible to:

- Secure future loans or credit cards

- Rent an apartment

- Get approved for a mortgage

- Even land certain jobs

Imagine being denied your dream home or losing out on a career opportunity because of past financial mistakes. The ghost of defaulted loans can follow you for up to seven years on your credit report.

The Relentless Pursuit of Collectors

Picture this: Your phone ringing off the hook, your mailbox overflowing with ominous letters, and the constant fear of answering a knock at your door.

This is the reality of life with debt collectors. They’re persistent, often aggressive, and their sole mission is to extract payment from you by any legal means necessary.

Legal Nightmares: When Creditors Sue

If you thought debt collectors were bad, wait until you’re staring down the barrel of a lawsuit. Creditors have the right to sue you for unpaid debts, and in most cases when you owe more than $5,000 in debt, they always will.

Here are some of the catastrophic consequences of being sued by your creditors:

- Wage garnishment: Up to 25% of your paycheck, gone before you even see it.

- Bank account seizures: Your hard-earned savings, vanishing in an instant.

- Liens on your property: Your home, your car, nothing is safe.

Imagine the shame of having your employer notified about your wage garnishment, or the horror of watching your life savings evaporate to satisfy a judgment.

The Ultimate Price: Bankruptcy

When all other options are exhausted, bankruptcy may seem like the only way out. But make no mistake, bankruptcy is not an easy escape. It’s a nuclear option that obliterates your financial life for almost a long time:

- Your credit is devastated for up to a decade

- You may lose valuable assets

- Future financial opportunities become nearly impossible

- The stigma can affect personal and professional relationships

Bankruptcy is a last resort that can leave deep scars on your financial and personal life for years to come. Filling for bankruptcy means you allow creditors to take everything you own and they will.

A Ray of Hope in the Darkness

The consequences of defaulting on personal loans are truly terrifying. But there’s hope. If you’re struggling with loan payments, don’t wait for the nightmare to unfold. Our debt settlement services can be your lifeline.

Alesure offers:

- Negotiation with creditors to reduce your debt

- Consolidate your high monthly payments into a single affordable payment

- Expert advice on managing your finances

- A path to financial recovery and peace of mind

Remember, every day you wait is another day closer to financial ruin. The choice is yours: face the terrifying consequences of default alone, or take the first step towards financial freedom with our expert help.

Don’t become another victim of personal loan default. Reach out now, before it’s too late. Your future self will thank you for having the courage to act today.