In our formative years, we spend countless hours learning algebra, history, and literature. Yet, when it comes to one of today’s most crucial skills—managing money—many of us find ourselves woefully unprepared.

The credit card debt amount households reached another all time high record last month. With almost 1.1 trillion dollar in credit card debt, Americans are the most in debt nation on earth.

With that being said, let’s explore some vital financial lessons that are often overlooked in traditional education, and how they can help us avoid the pitfalls of debt.

1. The True Cost of Credit

Credit cards can be a useful financial tool, but they can also be a gateway to crippling debt if mismanaged. What many don’t realize is the astronomical cost of carrying a balance. With interest rates often exceeding 27% APR, a $1,000 purchase can balloon into a much larger debt if only minimum payments are made.

2. The Power of Compound Interest

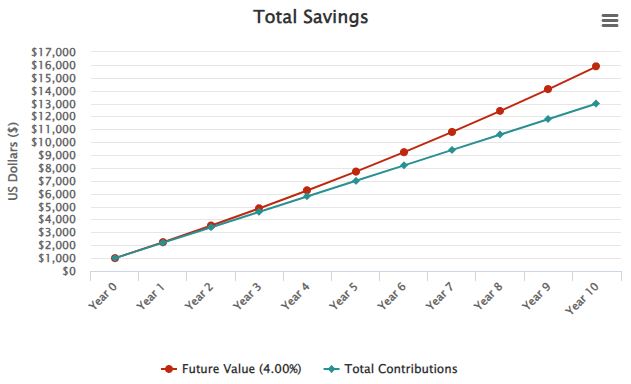

While we might learn about interest rate and the way it’s calculated in math class, its real-world application is rarely emphasized. Compound interest can work for you or against you. When you’re saving or investing, it’s your best friend. But when you’re in debt, it becomes your worst enemy.

Starting to save early, even small amounts, can lead to significant wealth over time due to compound interest. On the flip side, letting high-interest debt accumulate can create a financial hole that’s difficult to escape.

Take a look at the image above. This image shows how much you can save or make, if you start with an initial saving of a $1,000 and add $100 every month, with a 5% interest. So start saving now before it’s late!

If you find yourself in this situation, our debt relief services offer personalized debt management plans to help you break free.

3. The Importance of Budgeting

Creating and sticking to a budget is perhaps the most fundamental aspect of financial health, yet it’s a skill many of us never formally learn. A good budget isn’t about restriction—it’s about understanding your cash flow and making informed decisions.

A general rule of thumb is to not spend the money you don’t have, meaning you should not put unnecessary expenses on a credit card, hoping you would pay it next month with your future checks.

Start by tracking all your expenses for a month by looking at your bank statements. Look for recurring charges or things you don’t need and cancel them. We recommend reading our article on 10 things to do to save an extra $500 a month.

You might be surprised where your money is going. Then, allocate your income to different categories, ensuring you’re living below your means and saving for the future.

4. Emergency Fund: Your Financial Safety Net

Life is unpredictable, and unexpected expenses can derail even the best financial plans. That’s why having an emergency fund is crucial. Aim to save 3-6 months of living expenses in an easily accessible (aka cash) account.

Without this safety net, many people turn to high-interest credit cards or loans when emergencies strike, potentially starting a cycle of debt.

5. Understanding the True Cost of Large Purchases

When making big-ticket purchases like cars or homes, many focus solely on the monthly payment. However, it’s crucial to understand the total cost over time such as loan interest, asset depreciation (for assets like cars) insurance costs, yearly or monthly maintenance expenses, and other related expenses.

Costs like this can turn the real cost of a $500/mo monthly car payment into $900 a month without you even noticing it. A good rule of thumb when it comes to making large purchases is to ensure you can afford at least twice of the monthly payment comfortably.

For example, a car loan might seem affordable on a monthly basis, but factor in depreciation, insurance, gas, and maintenance, and the true cost of ownership becomes much higher.

6. The Value of Delayed Gratification

In our instant-gratification culture, the ability to delay purchases and save for them is an underappreciated skill. By saving up for purchases instead of using credit, you avoid interest charges and often make more thoughtful buying decisions.

Additionally, when using real cash instead of a credit card, you will truly feel the value of the purchase you’re making, leading you to make more thoughtful and careful decisions.

Conclusion

Mastering these financial skills can dramatically improve your financial health and help you avoid the stress of debt. However, if you find yourself already struggling with debt, remember that it’s never too late to take control of your finances with our debt relief services.